The rich guy always wins: ‘The Materialists’ and why we’re still wired for financial security in love

Financial security offers a buffer against uncertainty. In dating, a partner's stability becomes insurance for your future self. But are we solving money problems through romance?

I went to see Materialists a couple nights ago and (surprise!) I didn't like it.

I didn’t like it not just because it was poorly made (because, IMO, it was), but because it posed a question without really answering it.

The main question the film asks — does money matter in finding a partner? — sort of goes unanswered. Like yes, of course money matters! But it doesn't fully explore to what extent, and to how much, it matters. And how deeply personal it is.

The Materialists, as the title implies, is about trying to find love in a material world, a tale as old as time. It's the kind of story where hardened cynics like Lucy can only perceive of romantic relationships in capitalistic lingo — single people are evaluated by how "competitive" they are in "the market;" the most superficially desirable individuals (wealthy, "fit," and of a certain age), are "unicorns;" and marriage compatibility is treated like an equation where "the math has to add up."

What struck me wasn't the film's cynicism about modern dating, but how it reflected something much deeper about how uncertainty (economic, personal, etc.) reshapes romantic preferences. So let’s get into it.

When "gold digger" becomes "risk management"

Wanting a financially stable partner isn't purely mercenary. When Dakota Johnson's character Lucy chooses the wealthy, stable Harry over the passionate but financially precarious John, she's not calculating how many designer bags she can buy. She's calculating how many nights she'll sleep soundly.

Modern traits like money tap into aspects of our mating psychology that evolved to draw us toward partners who can provide the resources we need to survive and thrive. But there's something more immediate happening here.

Financial security offers a buffer against rent, healthcare, and emergencies. This isn't mere self-interest; it's partly risk management. In some ways, a partner's financial stability could become insurance for your future self.

Classic British romances, in which the marriage contract is paramount to the plot, served as reference points for Materialists. Pride and Prejudice's Darcy, Song points out, is a dreamboat because he's not only the love of Elizabeth Bennet's life but also solves her family's financial woes. Rom-coms and fairy tales have long depicted wealthy partners as safer choices — it's culturally ingrained.

Financial security in relationships has always been about emotional security masquerading as economic strategy. We're not necessarily attracted to wealth itself — we're attracted to the feeling of safety that wealth can provide. And in times of economic instability, that feeling becomes even more intoxicating.

Why does financial security matter so much *right now*?

I make my own money. I have my own savings, my own investment accounts, my own financial goals. I don't need anyone to take care of me financially. But do I find financial stability attractive in a partner? Absolutely. Not because I want to be taken care of, but because I want to build something together without the constant undercurrent of financial stress.

Let's talk about why this matters more now than it used to.

1. It’s evolution!

Starting with the assumption that the underlying function of mate choice is reproductive success, evolutionary psychologists have proposed that men should seek young, fertile, faithful women, and women should seek high-status, resourceful, committed men.

Such desires are born from evolved mate preferences for resource provision. But women's preference for financial security might also be a rational response to systemic inequalities — the gender pay gap, motherhood penalty, and workplace discrimination that make financial independence more precarious for women. Again, risk tolerance.

2. There are fewer eligible men!

Today, 47% of U.S. women ages 25 to 34 have a bachelor's degree, compared with 37% of men. The dating pool for college-educated people in their 30s now has five women for every four men.

This creates a mathematical problem for dating. People with college degrees tend to date other people with college degrees, but that tendency leads to a numerical mismatch. This scarcity makes financial stability an even more competitive advantage in the dating market.

3. Everything is feeling scary and uncertain!

Economic anxiety literally rewires our attraction patterns. During the 2008 recession, researchers found that both men and women shifted their partner preferences toward traits associated with resource acquisition and financial stability.

Today, well, look around. Housing costs that require dual incomes just to afford a one-bedroom apartment. Healthcare costs that can bankrupt you for getting sick. Retirement planning that assumes you'll work until you die. Is it really so unreasonable that we factor financial compatibility into romantic compatibility?

Also — World War 3 may be happening soon! There may be a recession coming, and AI may take all of our jobs. The world can feel pretty scary right now, and when we feel scared, we want to exert control how we can. Dating is one area we can exert that control.

The new financial dating signals

Dating apps have made this whole dynamic both more transparent and more complicated. Now we're not just picking up on financial cues through someone's job or neighborhood — we're literally swiping based on employment status listed in profiles.

The financial peacocking has gotten to be … a lot. It's not about flashing a Rolex anymore (though that still works). It's about the subtle signals: the stable job title, what neighborhood they live in, the college they went to, the vacation photos that suggest disposable income.

We've developed this whole language that pretends to be about “lifestyle” compatibility while actually being about how much money you have. How you highlight your interests on your profile may signal how you spend money and what financial expectations you have for your partner.

The psychology of financial disclosure in dating has become its own minefield. Mention your salary too early, and you're materialistic. Don't mention it at all, and you're hiding something. Share your financial goals, and you're calculating. Don't share them, and you're not serious about the future.

Meanwhile, the apps themselves profit from this anxiety. Premium features that let you filter by income or education level. Algorithm boosts for profiles that “signal” financial success. The platforms have monetized our insecurity about finding financially compatible partners.

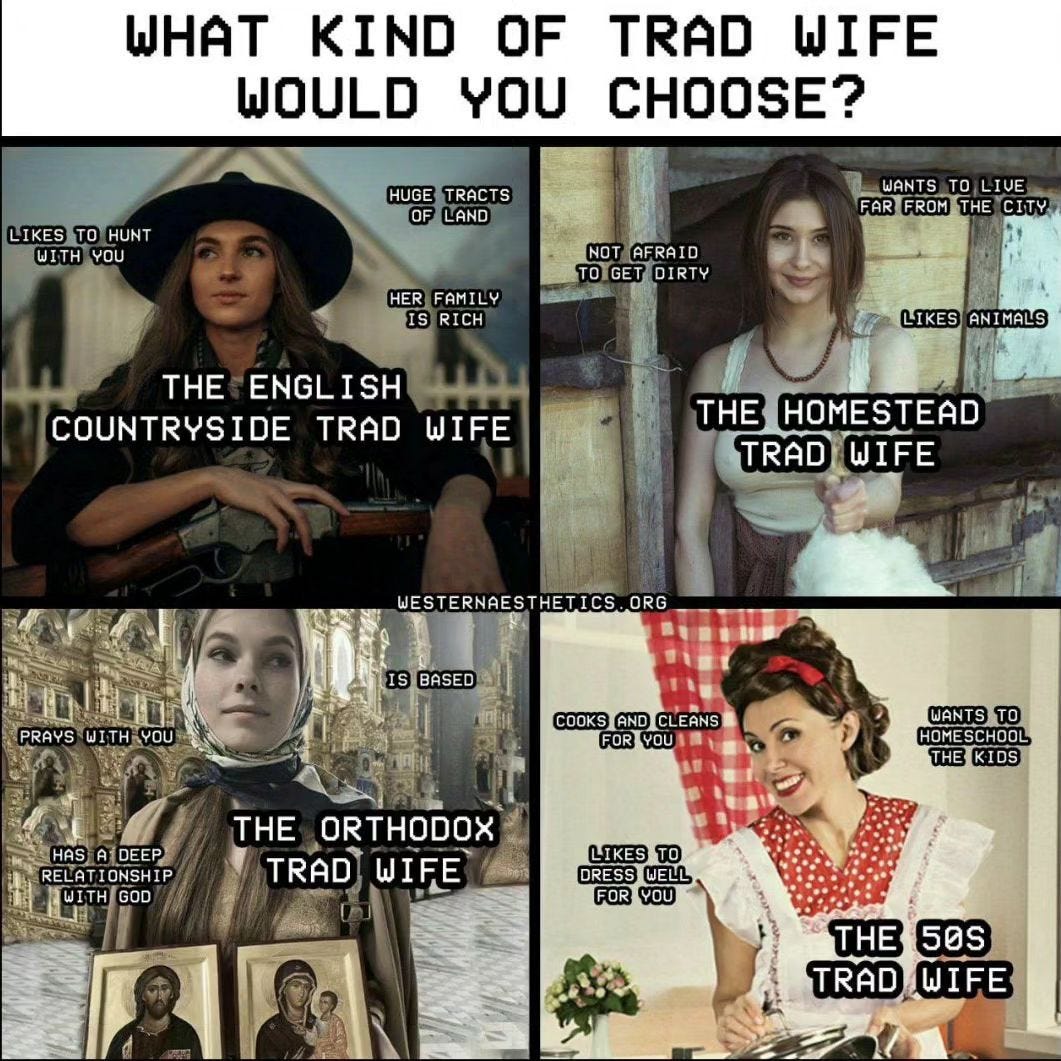

Ah, the tradwife: Financial independence through dependence

Which brings us to one of the most fascinating contradictions of our time: the rise of "tradwife" culture. At this point, there have been no shortage of think pieces about these women, which include the likes of Nara Smith and Hannah (of Ballerina Farm).

So I won’t dwell too much here — only to say that on the surface, this movement appears to reject the financial calculation that defines modern dating. But look closer, and you’ll find that most tradwife influencers are, ironically, financially independent through their content creation.

The lifestyle is performance — tradwife aesthetics are curated and monetized. These women often work through influencer businesses while glamorizing what looks like financial dependence.

The tradwife doesn't reject capitalism — it embodies it. They're selling the fantasy of financial security through traditional gender roles to an audience anxious about economic uncertainty.

This speaks to something larger about modern dating anxiety. When you're facing infinite choice on dating apps, economic uncertainty, and social pressure to "have it all," the clarity of traditional gender roles can feel like relief. But dependence on the long-term, unwavering attachment to another person is an objectively risky financial strategy.

When financial anxiety projects onto our partner choice

We're trying to solve our own money problems through our dating choices. Can't afford to buy a house alone? Date someone who already owns one. Stressed about your student loans? Find someone without debt. Worried about career stability? Seek out someone in private equity that can help you retire early, of course!

But you can't actually solve your own money psychology through someone else's bank account. Financial anxiety doesn't disappear when you date someone wealthy — it just changes shape. Instead of worrying about paying rent, you worry about losing access to their resources. Instead of feeling insecure about your own money, you feel insecure about your dependence on theirs.

The tradwife movement, or “stay-at-home girlfriend/wife” specifically often connects to broader conservative movements that promote financial dependence as virtue. But having only one breadwinner in the household creates asymmetry in partnerships.

The dependent partner may lack power in spending and saving decisions, or lack access to information about household finances, compromising her ability to partake in important financial decisions.

The difference between comfort and control

There's a clear difference between desiring financial comfort and seeking control through financial dependency — and how movies like Materialists often muddy that line.

I think part of why the financial attraction conversation feels so charged is because we're not being honest about what we actually mean by "financial security" in 2025.

It's not about finding someone to pay for everything anymore (and if it is, you may want to take a closer look at your values and why you feel that way). For most people, it's about finding someone who won't make your financial life harder. Someone whose money psychology is compatible with yours. Someone who's dealing with their own financial anxiety in healthy ways rather than destructive ones.

These aren't unreasonable criteria. They're actually pretty practical ones if you want a relationship that doesn't implode under financial stress.

But we're so afraid of appearing materialistic that we pretend these things don't matter. And then we wonder why so many relationships fail due to financial incompatibility.

The questions we should actually be asking

Instead of judging ourselves (or others) for caring about financial compatibility, maybe we should get better at understanding what we actually want and why.

Before your next relationship conversation about money, ask yourself:

Am I looking for someone to solve my financial problems, or someone who won't create new ones?

Are my financial attraction patterns based on actual compatibility or unresolved money anxiety?

Do I want partnership or rescue? (Both are valid, but they're different things)

How much of my financial attraction is about actual security versus status signaling?

What would I need to feel financially secure regardless of my partner's situation?

Because here's what I've learned: Financial compatibility in relationships isn't about finding someone rich enough to solve all your problems. It's about finding someone whose approach to money doesn't create more problems than it solves.

Sometimes that person happens to have a lot of money. Sometimes they don't. But they always have a healthy relationship with whatever money they do have.

The Materialists gets one thing right: We can't escape the economic dimensions of romantic relationships. But the question isn't whether money matters — it's how we can acknowledge its importance while holding space for actual connection.